As solar power output continues to grow, Europe is increasingly facing the risk of soaring negative electricity prices.

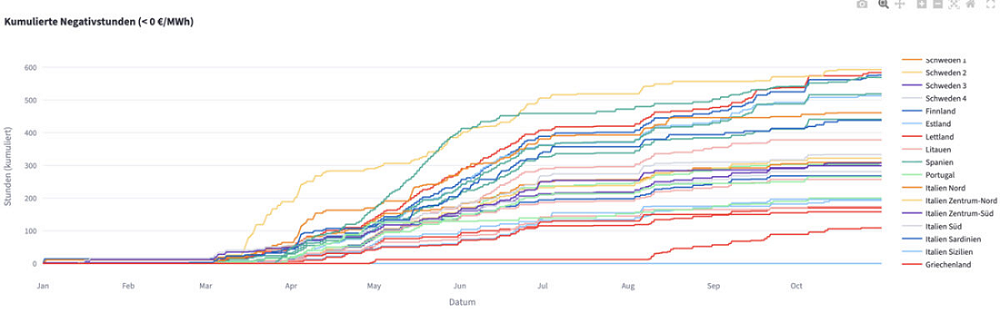

Driven by renewable energy oversupply and volatile weather conditions, Sweden, the Netherlands, Germany, Spain, and France have all recorded more than 500 hours of negative electricity prices this year.

According to analysis from the Strommarkt-App tool, the duration of negative price periods has risen sharply across the continent as soaring renewable generation and weather fluctuations strain Europe’s power systems. By the end of October, Sweden’s second price zone reported the highest number of negative-price hours at 593, followed by the Netherlands (584), Germany (576), Spain (569), Belgium (519), and France (513).

Negative price occurrences have also increased in Eastern Europe, though to a lesser extent. Finland and both Danish price zones each saw more than 400 hours of negative prices, while the Czech Republic, Poland, Hungary, Switzerland, Slovenia, Slovakia, and Croatia all recorded nearly 300 hours. Italy remains an exception, as national regulations prohibit negative pricing.

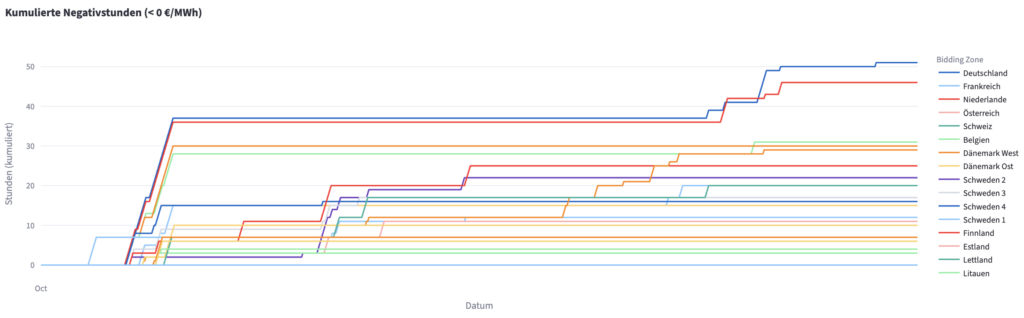

In October alone, Germany recorded the highest number of negative-price hours on the European Energy Exchange (51 hours), followed by the Netherlands (46 hours), Belgium (31 hours), and Western Denmark (30 hours). Spain and Finland also exceeded the European monthly average of around 19 hours, with 29 and 25 hours, respectively.

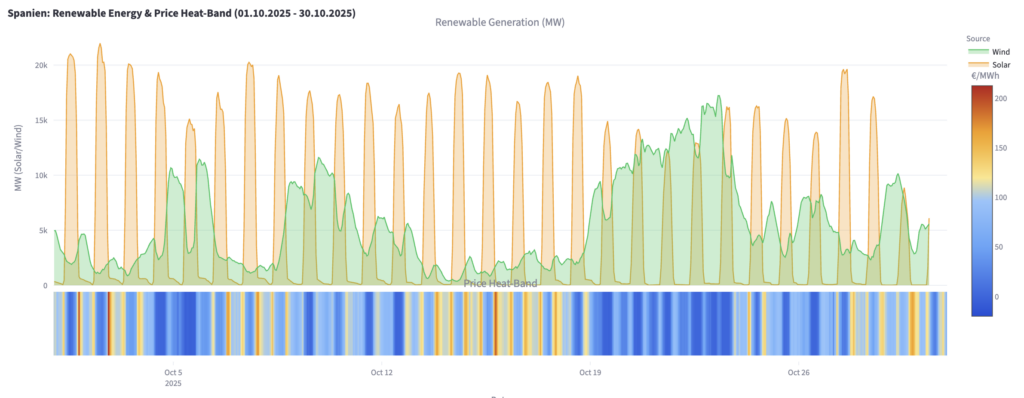

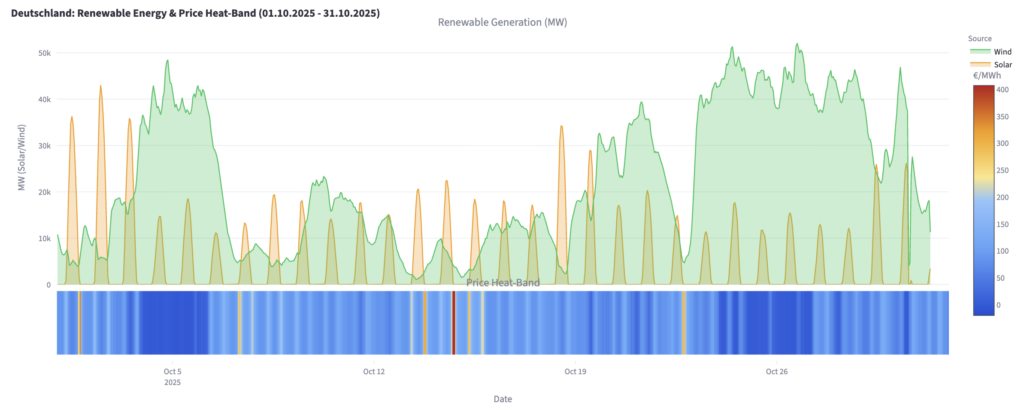

The main cause of October’s negative prices was likely autumn storms rather than solar overproduction. Nevertheless, Germany’s solar generation peaked at 43 GW on October 2. Even at midday that day, electricity prices held at €65/MWh ($75/MWh) — a relatively solid figure, according to market operators.

The impact of falling prices on solar revenues is reflected in capture prices — the average market price achieved by photovoltaic generation. In Germany, the solar capture price in October was €71.55/MWh, compared with an average market price of €84.40/MWh, resulting in a capture rate of 84.8%.

Austria’s PV capture price stood at €88.72/MWh versus a market average of €108.02/MWh (capture rate 81.5%). In Spain, PV generators earned just €42.36/MWh on average, well below the market average of €73.80/MWh (capture rate 57.4%). France recorded a capture price of €45.62/MWh, compared to a market average of €58.64/MWh, yielding a capture rate of 77.8%.